About the campaign

The Pennsylvania Abandoned Mine Land (AML) Campaign is a no-budget, no-letterhead group of organizations and individuals advocating for policies and programs that benefit the coal-impacted communities of Pennsylvania and beyond.

The organizations that participate in PA AML Campaign activities include local, regional, state-wide, and national non-profit organizations, county conservation districts, townships and municipalities, trade associations, landowners, business owners, sportsmen clubs, and individuals.

• Citizens Coal Council

• Eastern Pennsylvania Coalition for Abandoned Mine Reclamation (EPCAMR)

• Foundation for Pennsylvania Watersheds

• Mountain Watershed Association

• Pennsylvania Association of Conservation Districts

• Pennsylvania Environmental Council

• Trout Unlimited and many of its chapters

• Western Pennsylvania Coalition for Abandoned Mine Reclamation (WPCAMR)

• Western Pennsylvania Conservancy

We are advised by state and national agencies, associations, and commissions such as the Pennsylvania Department of Environmental Protection Bureau of Abandoned Mine Reclamation (PA DEP BAMR), National Association of Abandoned Mine Land Programs, and Interstate Mining Compact Commission.

Current Focus

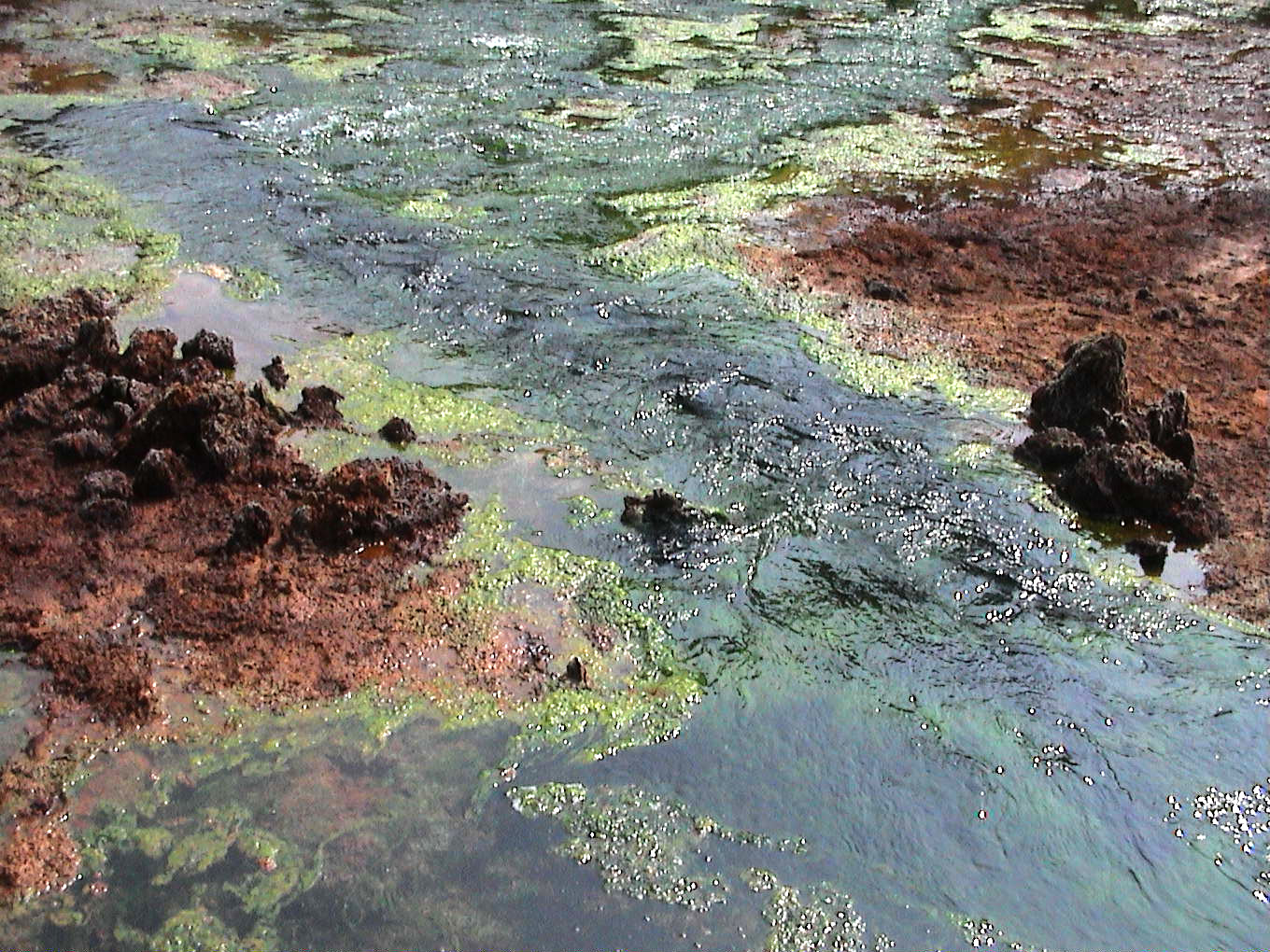

The Surface Mining Control and Reclamation Act (SMCRA) was sweeping federal legislation regulating coal mining in the U.S. Prior to its original passage in 1977, the coal mining industry was largely unregulated, especially with regard to the environment. Over a century of environmentally insensitive mining practices took a huge toll on the land and water where mining occurred. But SMCRA changed the face of the coal mining industry into one with a significantly smaller environmental impact. SMCRA also provided a dedicated, but insufficient and declining, source of funds for states and tribes to address some of the most dangerous abandoned coal mines. Over the years, SMCRA has been amended several times, most recently on November 15, 2021 with the passage of the bipartisan Infrastructure Investment and Jobs Act (IIJA) or Bipartisan Infrastructure Law (BIL). BIL provides Pennsylvania and the nation with a once-in-a-life time opportunity to further address the Abandoned Mine Drainage (AMD) caused by the unregulated mining practices of the past. This orange water coats our streams and causes thousands of miles of streams to not support life.

Through the federal BIL funding, Pennsylvania will receive approximately $244.9 annually for the next fifteen years. Missing from the legislation is the ability to retain some of those funds for the operation, maintenance, and rehabilitation of AMD treatment systems beyond the 15 year period covered by the BIL.

The STREAM Act (S3957) introduced by Senator Casey (D-PA) and Senator Braun (R-IN) in the Senate and by Representative Cartwright and Representative McKinley in the House addresses this omission to ensure that Abandoned Mine Land (AML) grants from the infrastructure law can be utilized in the same way as grants allocated from the AML Trust Fund. Specifically, this bill would:

- Authorize states to set aside up to 30 percent of their annual IIJA-AML grant into an account for the treatment and abatement of acid mine drainage

- Require annual reporting on the use and amount of funds set aside for acid mine drainage abatement

The PA AML Campaign is working to convince Congress to pass the STREAM Act. Passage of the STREAM Act will provide a mechanism that will allow Pennsylvania and other states affected by AMD to set aside a portion of their annual BIL grant to ensure the future operation of AMD water treatment infrastructure and not have those treatment systems become an unfunded taxpayer liability.

On July 30, 2022, the House of Representatives passed the STREAM Act - 391 yes votes and 9 no votes. We will continue to support Senator Casey's efforts to get the Senate to pass the STREAM Act.